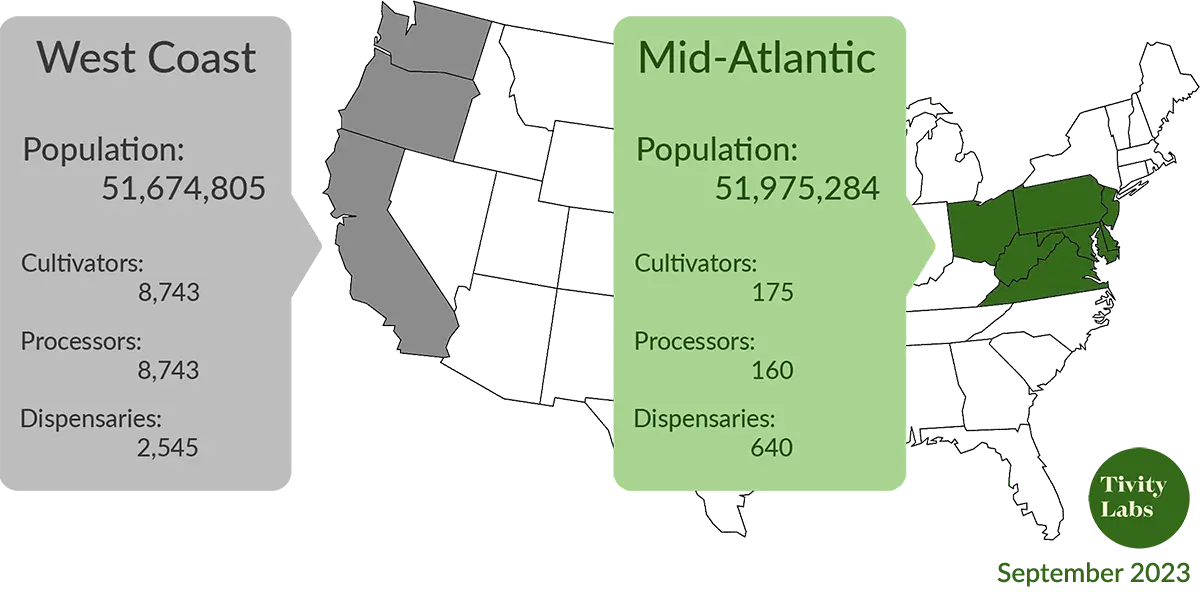

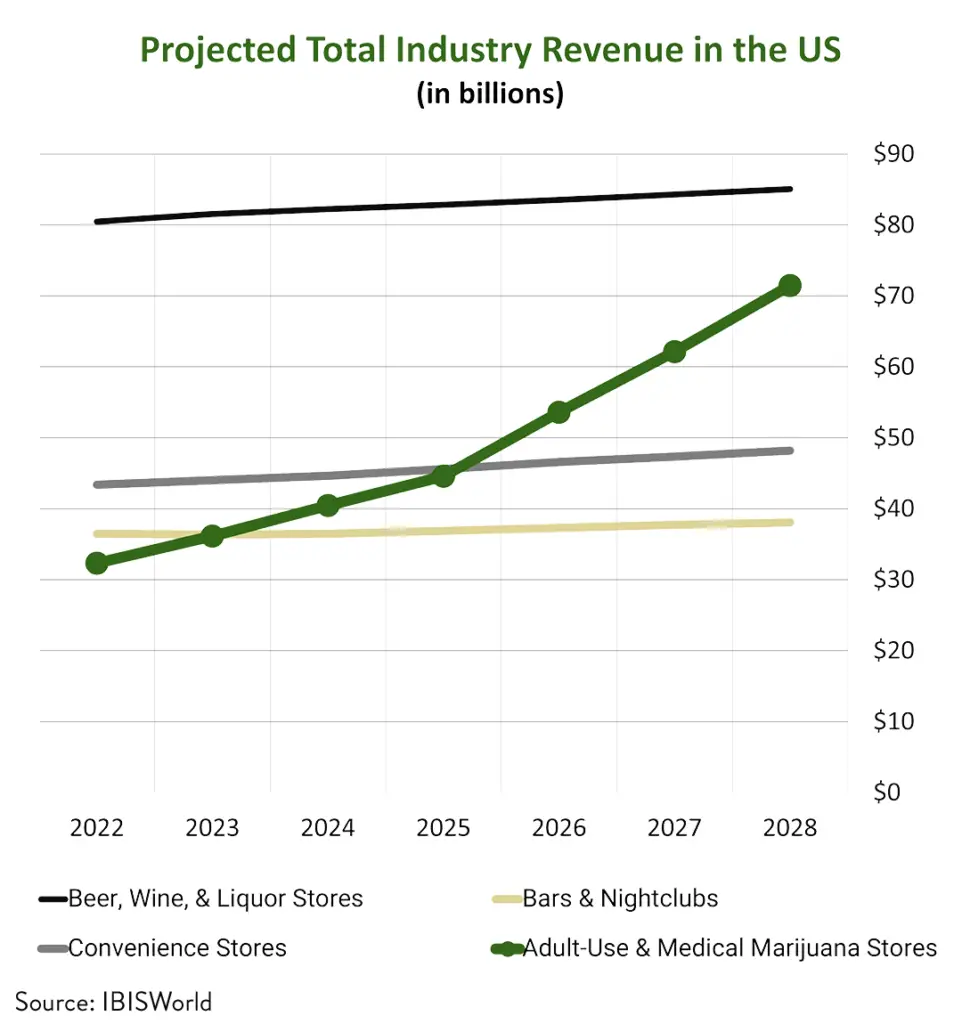

As the Pacific Coast reaches a saturation point, cannabis investors need to seek greener pastures for their capital. The Greater Mid-Atlantic region, with a comparable population size and the recent adult-use legalization vote, Ohio presents a huge opportunity. Early entrants in cannabis markets that recently legalized adult-use have the opportunity to quickly grow market share; offering the most upside for investors.